Property Financial Investment in New York State: A Comprehensive Guide

Buying real estate in New York State uses varied opportunities across its lively city facilities, picturesque suburban areas, and calm backwoods. Whether you're drawn to the bustling streets of New york city City or the harmony of the Hudson Valley, understanding the market dynamics and financial investment possibility is important. In this overview, we will explore why New York State is an appealing location genuine estate financial investment, essential regions to think about, and necessary pointers for success in this vibrant market.

Why Buy Property in New York City State?

1. Financial Durability and Diversity:

New York State boasts a diverse economy driven by industries such as finance, technology, healthcare, and tourist. This financial strength equates into stability for real estate investments, with regular demand throughout domestic, commercial, and mixed-use properties.

2. High Rental Need and Returns:

Cities like New York City, Buffalo, Rochester, and Albany experience strong rental demand as a result of their huge populaces, universities, and job possibilities. Capitalists can take advantage of affordable rental returns, specifically in neighborhoods with restricted housing supply and high tenant need.

3. Diverse Building Options:

From high-end apartments and historic brownstones in Manhattan to waterfront homes in the Finger Lakes, New york city State provides a variety of property kinds to suit various financial investment approaches. Whether you're interested in urban redevelopment jobs or vacation services in beautiful locales, there's an financial investment chance to match your objectives.

Secret Regions genuine Estate Investment in New York City State

1. New York City:

As a worldwide financial and social center, New York City continues to be one of one of the most sought after property markets on the planet. Areas like Manhattan's Upper East Side, Brooklyn's Williamsburg, and Queens' Long Island City offer possibilities for luxury condos, commercial homes, and mixed-use growths.

2. Hudson Valley:

The Hudson Valley region, recognized for its picturesque landscapes and historic communities, attracts citizens and tourists alike. Cities like Poughkeepsie, Kingston, and Beacon use opportunities for domestic financial investments, vineyard estates, and hospitality endeavors catering to visitors from close-by cities.

3. Long Island:

Long Island's proximity to New York City, beautiful beaches, and wealthy areas make it a desirable realty market. Financiers can discover opportunities in upscale residential properties, beachfront estates, and business growths along the island's lively seaside communities.

4. Upstate New York:

Upstate New york city encompasses areas such as the Finger Lakes, Adirondacks, and Resources Region, each offering distinct investment leads. From vacation homes in the Finger Lakes to tech industry growth in Albany, financiers can profit from price, beautiful beauty, and economic advancement outside of significant cities.

5. Western New York City:

Cities like Buffalo, Rochester, and Syracuse in Western New york city are experiencing revitalization and development in markets such as health care, education, and modern technology. Investors can think about residential properties, mixed-use developments, and flexible reuse jobs in these emerging urban centers.

Tips for Effective Real Estate Investment in New York State

1. Understand Green Springs Capital Group Citizen Market Trends:

Research study market patterns, market shifts, and financial signs impacting your target area. Stay informed about regional regulations, zoning laws, and growth jobs that could influence home values and investment returns.

2. Develop a Network of Professionals:

Connect with local real estate agents, residential property managers, attorneys, and financial experts who focus on New york city State's real estate market. Their expertise and insights can lead your financial investment decisions and browse complicated Green Springs Capital Group deals.

3. Diversify Your Portfolio:

Expand your investments across different property kinds, places, and market sections to spread threat and maximize returns. Take into consideration a mix of household, industrial, and hospitality residential or commercial properties based upon your danger resistance and financial investment purposes.

4. Examine Funding Options:

Check out funding options customized to real estate Real Estate Investment New York investments, such as standard home loans, business car loans, and collaborations with other financiers. Contrast interest rates, terms, and charges to optimize your financing method and enhance cash flow.

5. Prepare For Long-Term Development:

Develop a calculated financial investment plan lined up with your economic goals and time horizon. Screen market problems, property performance, and occupant demographics to adjust your strategy and take advantage of possibilities for lasting growth and success.

Purchasing property in New york city State offers investors a diverse variety of possibilities throughout its dynamic markets. Whether you're brought in to the busy environment of New York City or the peaceful landscapes of the Hudson Valley, tactical financial investments can yield considerable returns and long-lasting riches buildup. By understanding market trends, leveraging local knowledge, and diversifying your portfolio, you can navigate New York State's realty landscape with confidence and success.

Start your realty financial investment trip in New York State today and unlock the capacity for monetary growth and portfolio diversity in among the country's most resistant and satisfying markets.

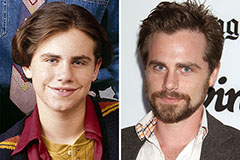

Rider Strong Then & Now!

Rider Strong Then & Now! Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!